Qbo Credit Card File Upload Problem Spent

Have you lot always wondered what the deviation between a pecker and an expense is in QuickBooks?

In this tutorial I'll teach you how they're different and when you should use one over the other by showing y'all:

- The difference between a bill and expense

- How to enter an expense

- How to enter a bill

- How to pay a bill

- How expenses and bills show upward differently in reports

Bill vs. Expense

Technically a bill is an expense. Withal, in QuickBooks, they practise have two different meanings.

A bill is money that your business organization owes simply will pay at a later date.

An expense is money that your business spends at the time of purchase.

If that'due south confusing allow me explain further.

When you buy a production or service for your business concern and pay with cash or check. Or if you pay online with a credit card, Paypal, or similar, that is an expense. The money left your business at the time of purchase.

If you purchase and receive a production or service but won't be paying for it right away, that would be a bill. You've purchased the production merely the coin volition not get out your concern' banking concern account until a later date.

Quickbooks has various reports that allow you to see outstanding bills. If you enter what should exist a bill as an expense information technology would non show upwards on those reports.

Quickbooks has various reports that allow you to encounter outstanding bills. If you enter a bill as an expense information technology won't show up on those reports and you won't know that you owe that money.

Let me prove you what it looks like to enter both a bill and an expense in QuickBooks.

Inbound an Expense into QuickBooks

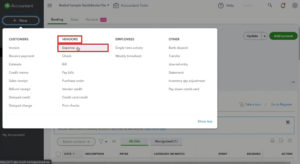

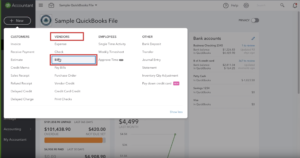

To create an expense in QuickBooks click on the Quick Create push. This is the large button in the upper left-hand corner that says "+ New"

In the bill of fare that opens click "Expense" in the Vendors column.

In this instance, I'k creating an expense for $100 worth of burgers purchased at Bob's Burger Joint. This was paid at the fourth dimension of buy from a checking account.

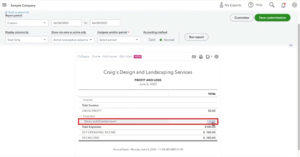

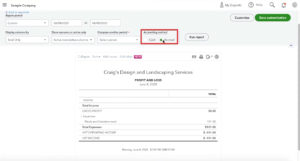

Let'due south see what this looks similar in the Profit and Loss study.

To view the Profit and Loss written report click on Reports in the left-paw menu and and then "Profit and Loss."

I can see that I have $100 in Meals and Entertainment expenses.

If I viewed any reports in QuickBooks that evidence upcoming bills this expense would not be there.

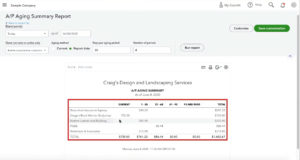

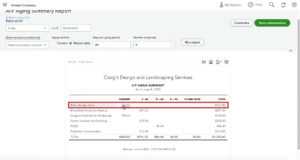

To see upcoming bills we'll view the Accounts payable aging summary report.

The easiest way to get to this report is to search for information technology from the Reports screen.

You can run into that Bob's Burger Joint is not listed in this written report.

I'll now enter this transaction as a bill and so you can see the difference.

Inbound a Pecker into QuickBooks

To create a bill click the quick create button and select "Beak" from the Vendor's column.

I'll at present recreate the buy of burgers from Bob's Burger Joint as a beak due in 10 days.

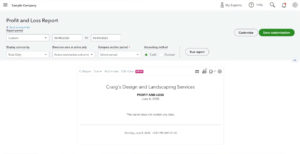

Now when I view the Profit and Loss study I once again meet this as an expense.

BUT, just if I have the bookkeeping method "Accrual" selected.

This is because accrual volition testify you pending invoices and bills. If I alter the accounting method to greenbacks the report is empty considering I oasis't yet paid the Bob's Burger Joint bill.

If I view the Accounts payable aging summary study I now run into the Bob's Burger Articulation pecker.

I'll now show you how to properly pay a bill in QuickBooks and what that looks similar in the reports.

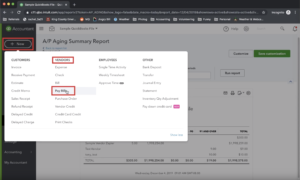

Paying a Nib in QuickBooks

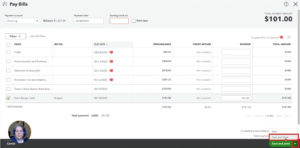

To pay a bill click the quick create button and select "Pay Bills" in the Vendors cavalcade.

The start stride will be to choose a payment method.

I'll be paying with a check and then it prompts me to enter a check number. If this was paid by automatic payment the bank check number field can be left blank.

To pay the Bob's Burger Joint bill I bank check it off in the listing of bills and verify the amount is right. And then click the dark-green save push button in the lower correct-mitt corner and select Save and close.

If I view the Turn a profit and Loss report once again I see the Bob's Burger Joint bill whether I select the cash or accrual accounting method. This is because the bill has been paid.

Y'all should NEVER create an expense to pay for something you've already entered as a beak. This will seriously screw upwards your accounting. E'er use "Pay Bills."

You now know the deviation between a bill and expense in QuickBooks and when you should use 1 over the other. If you lot'd like to watch me walk through this process check out the video below:

Source: https://www.gentlefrog.com/bill-vs-expense-in-quickbooks/

0 Response to "Qbo Credit Card File Upload Problem Spent"

Post a Comment